Based on Your Reading:

Get a Mesothelioma Treatment Guide

Find a Top Mesothelioma Doctor

Access Help Paying for Treatment

Mesothelioma treatments include chemotherapy, radiation therapy, surgery or a combination of these therapies. Immunotherapy, targeted therapy and palliative care may also be used. These supportive care treatments can help manage symptoms, improve quality of life and extend life expectancy.

Written by Dr. Daniel Landau • Edited By Walter Pacheco • Medically Reviewed By Dr. Jacques Fontaine

The Mesothelioma Center at Asbestos.com has provided patients and their loved ones the most updated and reliable information on mesothelioma and asbestos exposure since 2006.

Our team of Patient Advocates includes a medical doctor, a registered nurse, health services administrators, veterans, VA-accredited Claims Agents, an oncology patient navigator and hospice care expert. Their combined expertise means we help any mesothelioma patient or loved one through every step of their cancer journey.

More than 30 contributors, including mesothelioma doctors, survivors, health care professionals and other experts, have peer-reviewed our website and written unique research-driven articles to ensure you get the highest-quality medical and health information.

My family has only the highest compliment for the assistance and support that we received from The Mesothelioma Center. This is a staff of compassionate and knowledgeable individuals who respect what your family is experiencing and who go the extra mile to make an unfortunate diagnosis less stressful. Information and assistance were provided by The Mesothelioma Center at no cost to our family.LashawnMesothelioma patient’s daughter

Landau, D. A. (2024, April 18). Mesothelioma Treatment. Asbestos.com. Retrieved April 23, 2024, from https://www.asbestos.com/treatment/

Landau, Daniel A. "Mesothelioma Treatment." Asbestos.com, 18 Apr 2024, https://www.asbestos.com/treatment/.

Landau, Daniel A. "Mesothelioma Treatment." Asbestos.com. Last modified April 18, 2024. https://www.asbestos.com/treatment/.

The primary mesothelioma treatment options include chemotherapy, immunotherapy, radiation and surgery. Your diagnosis, including mesothelioma type, cancer stage and tumor location, determines which treatment is best for you.

The Mesothelioma Center at Asbestos.com surveyed more than 220 survivors, caregivers and loved ones in 2023. About 40% to 50% of respondents or respondents’ loved ones with mesothelioma were eligible for surgery. Most people – 32% – had chemotherapy and 10% said their treatment led to remission.

Related Videos:

Discuss your personal goals with your doctor and current mesothelioma treatment guidelines. Some patients prioritize focusing on feeling better rather than opting for aggressive treatments, and some patients prioritize extending survival, opting for multimodal approaches that may include surgery. A healthcare team of specialists will work together to create your personalized cancer treatment plan.

Get a Mesothelioma Treatment Guide

Find a Top Mesothelioma Doctor

Access Help Paying for Treatment

Mesothelioma surgery is a medical procedure that involves removing tumors, damaged tissue or fluid buildup. It can include removing a whole or part of a lung and aims to reduce tumor mass and symptoms.

Among respondents to our survey, 18% have had mesothelioma surgery. Of the group we surveyed who experienced remission, 25% underwent surgery.

Not all patients are eligible for surgery. Discuss with a doctor if it’s an appropriate treatment option for you. Patients eligible for mesothelioma surgery most often include those in good overall health. They tend to have early-stage mesothelioma with removable tumors.

Mesothelioma surgery benefits include extending life expectancy, reducing symptoms and improving quality of life. There are also risks associated with surgery. These include infection, bleeding and damage to surrounding tissues. It’s important to consider potential risks. Discuss goals with your doctor to determine if surgery is the right choice for you.

74%

The percentage of eligible survivors among survey respondents who chose to undergo mesothelioma surgery.

Source: The Mesothelioma Center at Asbestos.com, 2023

Chemotherapy for mesothelioma uses drugs to kill cancer cells or prevent growth. It’s a standard option for patients who aren’t eligible for surgery. Patients with any stage of cancer are eligible for chemotherapy. Those with advanced-stage mesothelioma or who aren’t surgical candidates may benefit more. Among respondents to our survey, 32% received chemotherapy, more than any other treatment. In our survey, Alimta and cisplatin were the 2 most common chemotherapy medications patients received.

Doctors often use chemo in combination with other cancer treatments. Physicians may give chemotherapy drugs alone or with other medications.

Chemotherapy benefits include improved symptom relief and a longer life expectancy. However, it also has risks, including various side effects such as nausea, fatigue and potential damage to healthy cells. Discuss your goals with a mesothelioma doctor to determine if chemotherapy is the right choice for you.

Radiation therapy uses high-energy radiation to destroy cancer cells and shrink tumors and is a standard treatment for mesothelioma. Physicians may combine it with other therapies. It’s often an option for patients who aren’t eligible for surgery or chemotherapy.

Patients eligible for radiation therapy include those with localized or advanced-stage mesothelioma. However, only 12% of those we surveyed received radiation. Many people with mesothelioma may not have considered adding radiotherapy to a multimodal plan.

Even if you already had surgery, you may still be eligible for radiation therapy. The benefits of radiation include reduced symptoms and an extended life expectancy.

However, there are also risks and side effects associated with radiation therapy. These include fatigue, skin irritation and damage to healthy cells. Talk with your doctor to determine if radiation therapy is the right choice for you.

Mesothelioma immunotherapy uses the body’s immune system to detect and remove cancer cells. The FDA recently approved these therapies as a new option for mesothelioma patients. Keytruda (Pembrolizumab) was the first approved immunotherapy. The combination of Opdivo (nivolumab) and Yervoy (ipilimumab) was then also FDA-approved.

In our unique survey, 26% of people said they received mesothelioma immunotherapy, the second-highest response. 17% of patients who experienced remission had undergone immunotherapy. Opdivo was the most common and Yervoy the second most common mesothelioma immunotherapy medication among respondents.

Immunotherapy has revolutionized survival for patients with cancers that were historically very difficult to treat like mesothelioma.

Immunotherapy drugs activate immune cells, the same ones that fight infection, to locate and destroy mesothelioma cancer cells. Some immunotherapies target unique mechanisms. For example, Avastin (bevacizumab) can restrict the growth of blood vessels on tumors, depriving them of oxygen and nutrients.

This type of targeted therapy can improve well-being and extend life expectancy. Many patients have fewer or less severe side effects than with chemotherapy. Side effects can include fatigue and skin rashes. In some cases, inflammation can affect sensitive organs.

John Fiala, a Navy veteran who served aboard the USS Saratoga, was told his mesothelioma was too advanced for surgery. Chemo initially stopped tumor progression, then it restarted. A clinical trial for Opdivo and Cyramza is working exceptionally well for him. He raves about guidance from Patient Advocate Amy Pelegrin and VA-accredited claims agent Aaron Munz at The Mesothelioma Center.

Multimodal therapy for mesothelioma combines a mix of treatment approaches, such as surgery, chemotherapy and radiation. One treatment is often not enough to control the cancer, but a combination of treatments gives the patient a better chance of living longer.

Thoracic surgeon Dr. Jacques Fontaine explained to us how multimodal teams work. “Thoracic surgeons, medical oncologists, radiation oncologists, pathologists who all work together under one roof as a team,” he said. “That’s what major mesothelioma centers offer: different specialists from different disciplines all working to care for one patient.”

People diagnosed in an early stage of cancer and who are otherwise healthy are the best candidates for multimodal treatment. Those with other diseases or poor health may be unable to tolerate the side effects of multiple treatments.

Multimodal therapy is different for everyone. “Mesothelioma treatment is quite complex,” Fontaine told us. Doctors look at each patient’s unique diagnosis to create the best plan. Depending on your response, your doctor may add or remove therapies throughout your treatment journey.

Palliative care for mesothelioma is a medical approach to addressing cancer symptoms without significant side effects from treatment. Aiming to help patients feel better and live longer, it often involves traditional therapies such as chemotherapy or surgery, but at lower doses or with less invasive means.

Many patients benefit from palliative care when started alongside their standard treatment. For example, low-dose chemotherapy can help shrink tumors before aggressive mesothelioma surgery.

A palliative care team can include oncologists, surgeons, nurses, pain experts, physical therapists and dietitians. They all work together to ensure the patient gets the best care possible.

Alternative therapies such as acupuncture, massage and relaxation techniques, may also help reduce symptoms for some people alongside palliative care. Exercise, physical therapy and respiratory therapy can help patients develop stronger muscles to offset the pain and weakness mesothelioma treatment can cause.

Clinical trials are research studies that test the safety and efficacy of medications or procedures for mesothelioma. Mesothelioma clinical trials provide access to cutting-edge therapies, such as Tumor Treating Fields. Mesothelioma vaccine therapy, for example, is only available through clinical trials.

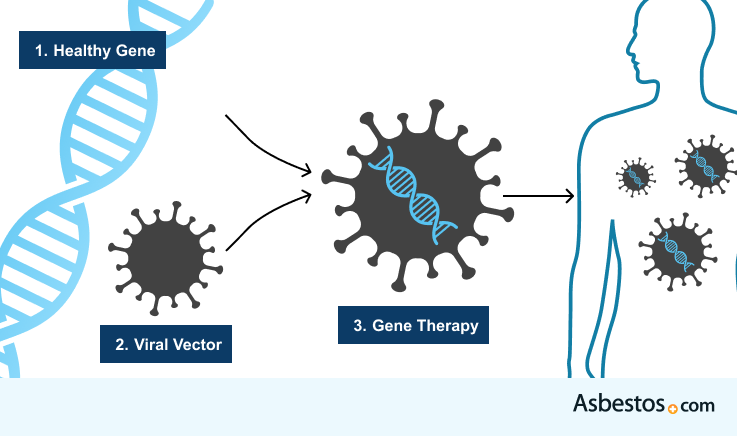

Emerging treatments like mesothelioma gene therapy are still under investigation, but could lead to improvements in survival in the future. Gene therapy changes the body’s genetic material to help fight disease. Some scientists believe that just like damaged genes can cause cancer, changing genes in the right way might help treat it.

Suicide gene therapy involves modifying a virus or bacterium, for example E. coli, to deliver a cancer-killing gene inside mesothelioma cells. Cancer vaccines also help the immune system recognize antigens on cancerous cells and kill the cells.

Clinical trials offer access to innovative therapies and viable options for patients who have exhausted other treatments. Your doctor can help you determine if you’re eligible. Clinical trials may provide hope for better outcomes for many mesothelioma patients.

Finding a top doctor and cancer center as soon as possible following a mesothelioma diagnosis is essential. When looking for a specialist, consider what’s most important to you. Our Patient Advocates can help you determine if their specific experience and track record of success is the best fit for your treatment needs.

A mesothelioma diagnosis can feel overwhelming for you and your loved ones. Remember that treatment options are available, and our Patient Advocates are here to guide you through the next steps of your mesothelioma journey.

Have a question? Contact one of our Patient Advocates and get the answers you need.

Connect, share stories and learn from the experiences of others coping with mesothelioma in one of our support groups.

We help support charities, hospitals and awareness groups working to help people impacted by asbestos and cancer.

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you are looking for mesothelioma support, please contact our Patient Advocates at (855) 404-4592