Financial Toxicity of Cancer Treatment: A Hidden Side Effect

Written by Karen Selby, RN • Edited By Walter Pacheco

Asbestos.com is the nation’s most trusted mesothelioma resource

The Mesothelioma Center at Asbestos.com has provided patients and their loved ones the most updated and reliable information on mesothelioma and asbestos exposure since 2006.

Our team of Patient Advocates includes a medical doctor, a registered nurse, health services administrators, veterans, VA-accredited Claims Agents, an oncology patient navigator and hospice care expert. Their combined expertise means we help any mesothelioma patient or loved one through every step of their cancer journey.

More than 30 contributors, including mesothelioma doctors, survivors, health care professionals and other experts, have peer-reviewed our website and written unique research-driven articles to ensure you get the highest-quality medical and health information.

About The Mesothelioma Center at Asbestos.com

- Assisting mesothelioma patients and their loved ones since 2006.

- Helps more than 50% of mesothelioma patients diagnosed annually in the U.S.

- A+ rating from the Better Business Bureau.

- 5-star reviewed mesothelioma and support organization.

Testimonials

My family has only the highest compliment for the assistance and support that we received from The Mesothelioma Center. This is a staff of compassionate and knowledgeable individuals who respect what your family is experiencing and who go the extra mile to make an unfortunate diagnosis less stressful. Information and assistance were provided by The Mesothelioma Center at no cost to our family.LashawnMesothelioma patient’s daughter

How to Cite Asbestos.com’s Article

APA

Selby, K. (2024, February 2). Financial Toxicity of Cancer Treatment: A Hidden Side Effect. Asbestos.com. Retrieved April 16, 2024, from https://www.asbestos.com/treatment/expenses/financial-toxicity/

MLA

Selby, Karen. "Financial Toxicity of Cancer Treatment: A Hidden Side Effect." Asbestos.com, 2 Feb 2024, https://www.asbestos.com/treatment/expenses/financial-toxicity/.

Chicago

Selby, Karen. "Financial Toxicity of Cancer Treatment: A Hidden Side Effect." Asbestos.com. Last modified February 2, 2024. https://www.asbestos.com/treatment/expenses/financial-toxicity/.

Feeding into this growing phenomenon is the fact that out-of-pocket insurance costs continue to rise for the more than 1.9 million Americans projected to receive a cancer diagnosis this year.

Cancer is one of the most expensive conditions to treat in the U.S. and is also the second-leading cause of death in the country. The American Association for Cancer Research estimates that the annual cost of cancer is expected to reach almost $246 billion by 2030, up 34% from 2015.

Understanding cancer-related terminology such as financial toxicity enables cancer patient and their loved ones to better comprehend and plan for the overwhelming realities of a cancer diagnosis. Here we will offer a deeper understanding of financial toxicity and its impact on cancer patients and their families.

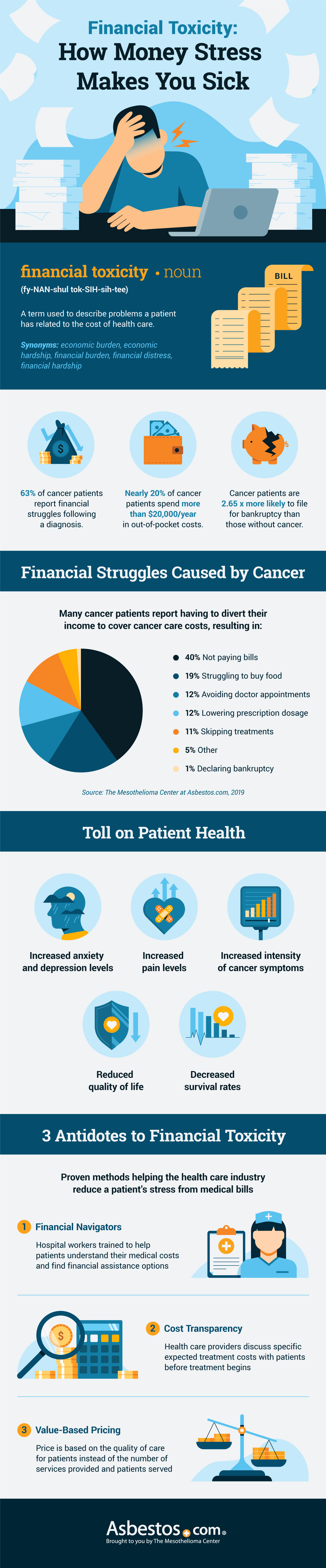

What Is Financial Toxicity?

Financial toxicity is loosely defined by the National Cancer Institute as “problems a patient has related to the cost of medical care.” These concerns often stem from an accumulation of out-of-pocket costs, which are the patient’s financial responsibility for any medical expenses not covered by their health insurance.

These economic burdens may be caused by a lack of health insurance or having expensive medical bills not covered by insurance. Struggles with these financial problems often lead cancer patients into debt, out of retirement or even directly to bankruptcy.

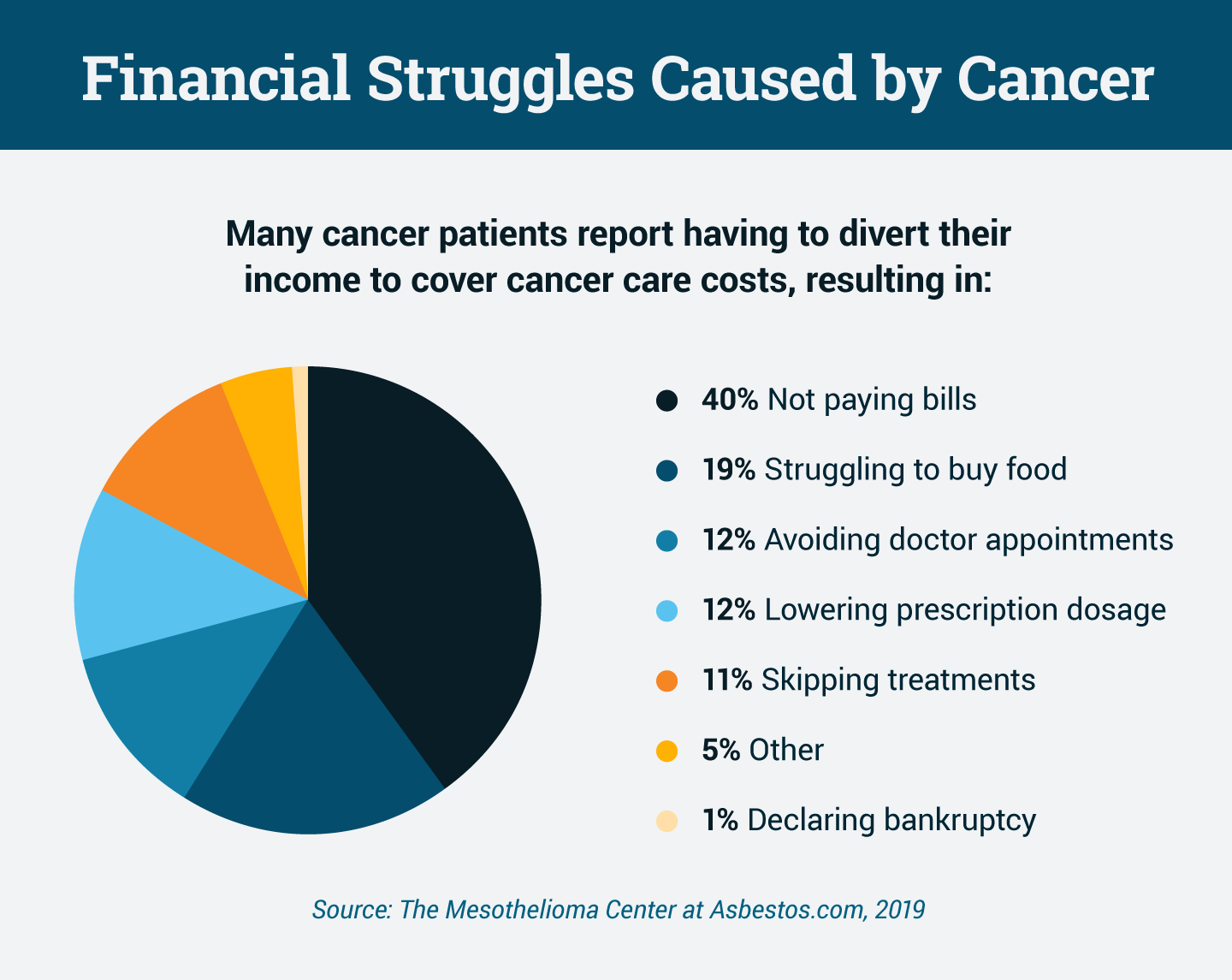

A patient’s quality of life and access to medical care may suffer due to financial toxicity. To save money, some patients opt to not take costly prescription medicine, avoid going to the doctor or cancel planned procedures such as radiation or surgery.

- Financial distress

- Financial hardship

- Financial burden

- Economic burden

- Economic hardship

Financial Toxicity by the Numbers

Cancer patients are more likely to experience financial toxicity than people who don’t have cancer due to the higher out-of-pocket spending required for the chronic illness. According to some survivors, their medical care expenses totaled more than 20% of their annual income.

- 63% of cancer patients and their families report financial struggles following a cancer diagnosis. (The Mesothelioma Center)

- Cancer patients are 2.65 times more likely to file for bankruptcy than those without cancer, and cancer patients under the age of 65 had rates of bankruptcy two to five times higher than those 65 or older. (Health Affairsa)

- It took only two years for 42% of the 9.5 million cancer patients diagnosed between 2000 to 2012 to drain their life savings. (American Journal of Medicine)

- Patients who experience bankruptcies are at a higher risk of early death. (Journal of Clinical Oncology)

Heavy Financial Costs of Cancer

It’s easy to see how expensive cancer treatments and insurance red tape can lead to debt and frustration for many patients. One recent report stated that in 2019, U.S. cancer patients paid an estimated $16.2 billion in out-of-pocket cancer care costs and accumulated nearly $5 billion in lost work hours. A survey from The Mesothelioma Center revealed that nearly 20% of cancer patients spent more than $20,000 each year in total out-of-pocket costs.

Risk Factors for Financial Toxicity

- Stage of Cancer: The more advanced your cancer is, the harder it becomes to maintain a steady income.

- Cancer Treatment Plan: Those who have received radiation or chemotherapy previously tend to experience more financial toxicity, juggling bills coming from all areas of care.

- Demographics:

- Patients under the age of 65 face more significant challenges with financial toxicity because they have not had time to build savings and often must juggle other life responsibilities such as parenting.

- The CDC acknowledges racism as a serious public health threat due in part to reduced access to cancer screenings and other preventative health measures as a result of racial disparities. With less access to these screenings, minority populations are often diagnosed in later stages of cancer when treatment and care costs are more extensive.

- Patients from lower-income households have a higher risk of financial toxicity because of an increased risk of losing a job due to complications from their illness.

- More than 1 in 3 patients experienced a change in their employment status because they were unable to work while fighting cancer. A job loss or reduction in hours and pay intensifies the strain on households trying to manage the added expenses associated with cancer treatment.

- Insurance Status: The uninsured, underinsured or those who simply do not have access to government-supported medical coverage such as Medicare are more at risk.

Health Impact of Financial Toxicity

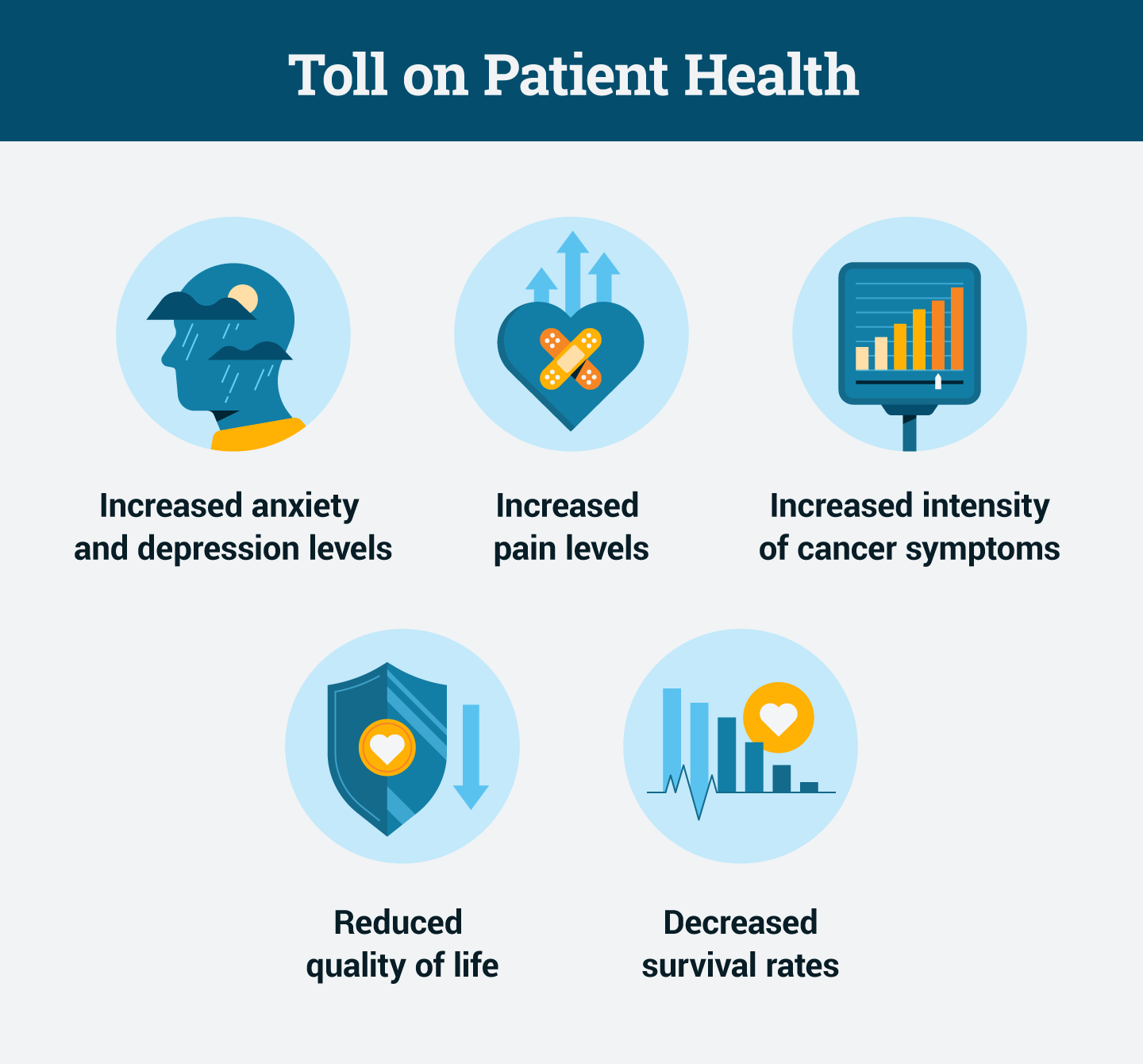

Just as chemotherapy drugs are more toxic to some patients than others, the potential financial toxicity from cancer treatment costs depends on each individual’s personal financial situation. Patients impacted by financial toxicity are more likely to make poor health care decisions, bringing about greater risk for less positive health outcomes.

Financially distressed patients often make the risky choice to take medications less often or in lower doses than directed in order to make each prescription last longer. Some patients even skip checkups, follow-up tests or treatment appointments to save money. Those who don’t take their medications or miss treatments are more likely to require hospitalization at a later point.

Budget concerns cause patients so much stress that some have acknowledged they worry more about paying for cancer treatments than the disease itself.

The combination of increased stress and reduced treatments and medication can have an impact on a patient’s well-being.

- Poor quality of life

- Greater intensity of cancer symptoms

- Increased mental health challenges

- Higher pain levels

- Lower survival rates

However, there are many organizations, such as The Mesothelioma Center, that can help find financial resources and legal options for patients and their loved ones.

Why Is Financial Toxicity Getting Worse?

Over the past two decades, the cost of cancer treatment has drastically risen, leading to an epidemic of financial toxicity. While scientific advancements have led to more treatment and medication options, the costs of accessing them have become a significant barrier for patients. One report found that the current annual average price of new cancer medications ranged from $90,000 to $300,000 each.

At the same time, health insurers have been looking for ways to shift more medical costs to patients. Consumers unfamiliar with the jargon of health insurance often don’t realize when a reduction in their coverage occurs.

- Higher premiums mean you must pay more money per month for the same benefits.

- Higher deductibles mean you must pay more money out of pocket before your insurer pays a claim.

- Higher coinsurance and copayments mean you must pay more money out of pocket even after you’ve met your deductible.

The reasons for these ongoing insurance increases are varied. They range from the increasing number of Americans 65 years of age or older, evolving changes in disease incidence and pricing increases for services provided.

Strategies for Ending Financial Toxicity

Finding ways to decrease or even eliminate financial toxicity requires strategies from individual patients, doctors and entire hospital and pharmaceutical systems.

- Patients should consider working with financial navigators. These hospital workers specialize in helping patients understand their medical costs and help them take advantage of financial assistance opportunities. Some government financial assistance programs can be a great relief for overburdened patients and their families.

- Many experts suggest a hospital should provide cost transparency to address financial toxicity. This allows health care professionals to review all anticipated treatment costs with patients before treatment begins. Some doubt the effectiveness of cost transparency, noting that it can backfire if patients conflate costs with effectiveness.

- Value-based pricing is another strategy hospitals may consider. This customer-focused model means the cost of treatment is based on the quality of care for patients instead of the number of services provided or patients served. In terms of cancer care, value-based pricing would allow patients more access to higher-value treatments with lower out-of-pocket costs.

The mental and physical stress brought on by financial toxicity can be debilitating for some patients. But help is available. As your treatment plan evolves, be sure to advocate for yourself and push to obtain the information you need to make a fully informed decision about your care. By taking some control over your medical bills, you’ll have a greater likelihood of reducing the impact of financial toxicity on your life.