Mesothelioma and Asbestos Trust Funds

Asbestos trust funds are accounts bankrupt companies set up for mesothelioma survivors. Experts estimate the current amount is $25 billion to more than $30 billion. The average asbestos trust fund payout can range from $7,000 to $1.2 million. A mesothelioma lawyer can help you file a claim.

What Are Mesothelioma Trust Funds?

People who were directly exposed to asbestos and diagnosed with an asbestos-related disease like mesothelioma, lung cancer, and asbestosis may be eligible to file asbestos trust fund claims. Those exposed through secondhand exposure and family who lost a loved one as a result of asbestos exposure may also qualify to file a claim.

Because of privacy issues and other legal complexities, not all individual mesothelioma trust fund payouts are disclosed. Some funds share the remaining amounts, while others don’t. This makes it hard to estimate average payouts and the remaining amounts in various funds.

Key Facts About Mesothelioma Trust Funds

- Experts estimate the amount currently available in mesothelioma trust funds to be anywhere from $25 billion to more than $30 billion.

- Trust fund payout amounts are often kept private, but experts indicate they can range from $7,000 to $1.2 million with a median claim value of $180,000.

- More than 60 active mesothelioma trust funds set aside $30 billion for future claims.

- Most claims are processed within 3-6 months, but expedited claims can be sooner. Your processing time will depend on the complexity of your claim.

Companies created these trust funds after mounting lawsuits over asbestos exposure led them to declare bankruptcy. As a condition of their Chapter 11 bankruptcy protection, mesothelioma trust funds were created to manage current and future claims. The first mesothelioma trust fund, the Johns Manville Asbestos Trust, was created in 1988 with $2.5 billion set aside.

Mesothelioma trust funds continue to be created. For example, Duro Dyne Asbestos Trust Fund began accepting claims in September 2021. Billions of dollars are currently available in these funds. A mesothelioma lawyer can help you file your mesothelioma trust fund claim.

Who Is Eligible to File an Asbestos Trust Fund Claim?

People who were directly exposed to asbestos and developed a qualifying asbestos-related disease like mesothelioma may be eligible to submit an asbestos trust fund claim. Those exposed through secondhand exposure and family who lost a loved one as a result of asbestos exposure may also qualify to file a claim.

People Who May Be Eligible

- Consumers who used asbestos-containing products and developed illnesses

- Family members who lost a loved one as a result of their asbestos exposure

- People who lived near asbestos processing plants, factories and other facilities responsible for exposing the public to asbestos

- Workers exposed to asbestos on the job

A mesothelioma attorney can let you know if you qualify. If the company responsible for your exposure and diagnosis has a mesothelioma trust fund, talk to a lawyer about filing a claim.

People with mesothelioma or their estate may be eligible to file claims with more than one trust fund. They can investigate your asbestos exposure history to determine which companies are liable.

Filing Limitations for a Mesothelioma Trust Fund Claim

Laws and courts have established limits on how long people have to file claims with asbestos trust funds. Regulations also differ from state to state regarding how trust fund claims impact lawsuits.

Variables to Discuss With Your Lawyer

- Filing multiple claims and lawsuits: In some cases, people can file asbestos trust claims and lawsuits. Various asbestos state laws require them to disclose their past claims.

- Information sharing: State courts have different rules on sharing trust claim information with lawsuit defendants. Some require disclosure of any claims submitted to trusts during the discovery phase.

- Setoffs: These are deductions from compensation like verdicts and settlements based on whether or not you’ve received payouts from asbestos trust funds. States including Illinois, New York, Texas and West Virginia permit setoffs for trust payments.

- State laws: State laws dictate how compensation determines lawsuit awards.

- Statutes of limitations: Unlike mesothelioma statutes of limitations, which each state’s laws determine, every asbestos trust fund sets its own limits for filing a claim. This period is generally around 2 to 3 years after a mesothelioma diagnosis.

Before filing a trust fund claim, you should know all of your legal options. A qualified mesothelioma lawyer can help you navigate this process. They’ll determine if filing an asbestos trust fund claim is right for you.

Use our calculator to quickly understand what compensation you may be eligible for and understand your rights — all at no cost to you.

Mesothelioma Trust Fund Payouts

While individual mesothelioma trust fund payout amounts are often undisclosed, experts look at research from organizations like RAND and see a wide range of payout amounts. The range of trust fund payouts can be anywhere from $7,000 to $1.2 million. The median value for mesothelioma claims is $180,000 with some experts suggesting the average individual payout is $300,000 to $400,000.

Attorney Jim Kramer of Simmons Hanly Conroy tells us, “To receive compensation from asbestos trust funds, it’s essential to have a lawyer who knows the ins and outs of asbestos litigation.” The amount of compensation for mesothelioma a claimant can receive from an asbestos trust depends on the payment percentage and other factors.

Factors Impacting Asbestos Trust Fund Payouts

- Current payment percentage for the trust

- Payment schedule the trust established

- Type of asbestos-related disease

Each asbestos trust assigns specific claim values to mesothelioma, lung cancer and asbestosis diagnoses. Mesothelioma claims receive higher payouts. This “schedule” involves many factors. One usual example is how much the company paid per claim before filing for bankruptcy.

The average amount people receive from a mesothelioma trust fund is less than the average trial verdict of $20.7 million or $1 to 2 million for an asbestos settlement. However, asbestos trust fund claims are usually a faster way to receive compensation and don’t involve having to go to court.

How Much Money Is Left in Asbestos Trust Funds?

Experts debate the precise amount of money left in asbestos trust funds, though many suggest it’s more than $30 billion. About $25 billion was left in asbestos trust funds in 2016, according to the most recent estimate in a 2018 U.S. Chamber Institute for Legal Reform report.

The actual amount is difficult to determine. Several new trusts have formed in the last few years. Trusts also make investments to help increase the amount available for mesothelioma survivors and their families.

How Do Trust Fund Payment Percentages Work?

Trust funds offer a set payment percentage of a claim’s value to preserve money for people diagnosed years from now. Trust administrators evaluate the percentage regularly to ensure enough funds remain for future claims.

For example, if a claim is worth $180,000, and the trust’s payment percentage is 25%, then the payout would be $45,000. That compensation may be enough to cover medical bills and lost wages.

List of Asbestos Trust Funds

Dozens of asbestos companies, including Johns Manville, W.R. Grace and United States Gypsum, have set up trust funds. These companies include manufacturers in a variety of industries that had facilities across the U.S. The following list includes some asbestos trust funds available to mesothelioma patients and their families.

| Company | Estimate of Initial Assets | Year Established |

|---|---|---|

| United States Gypsum Trust | $3.9 billion | 2006 |

| Owens Corning Corporation Trust | $3.4 billion | 2006 |

| Pittsburgh Corning Corporation Trust | $3.4 billion | 2011 |

| W.R. Grace and Co. Trust | $2.9 billion | 2001 |

| DII Industries Trust | $2.5 billion | 2005 |

| Johns-Manville Corporation Trust | $2.5 billion | 1988 |

| Armstrong World Industries Trust | $2 billion | 2006 |

| Western Asbestos (Western MacArthur) Trust | $2 billion | 2004 |

| Babcock & Wilcox Trust | $1.8 billion | 2006 |

| Owens Corning Fibreboard Subfund Trust | $1.5 billion | 2006 |

The funds these companies established during their bankruptcies consist of billions of dollars. The purpose of these funds is to compensate for future asbestos claim from people with asbestos-related diseases and their families.

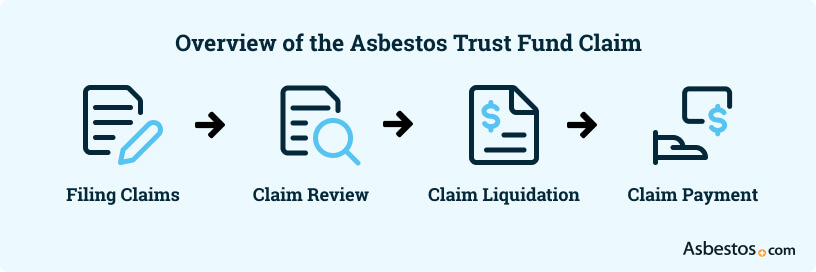

How to File an Asbestos Trust Fund Claim

You must be eligible and provide evidence to file a mesothelioma trust fund claim. The first step is to speak with a lawyer who can help you get the documentation to meet the fund’s eligibility criteria. Your lawyer will gather the evidence before filing the claim.

Finding a lawyer with experience in mesothelioma trust fund claims is essential. They’ll guide you through these steps to give you peace of mind and let you focus on your recovery.

Step 1: Meet Trust Fund Criteria

Each asbestos trust fund sets its criteria that potential claimants must meet to file a successful claim. The trust fund’s website typically outlines these requirements.

Common Asbestos Trust Fund Criteria

- Information or evidence about the products that led to your asbestos exposure

- Proof of an asbestos-related diagnosis

- Statute of limitations for filing a claim

- When your asbestos exposure occurred

- Where the exposure took place

The criteria changes depending on many factors. These can include the place of exposure, the types of products involved and when the company used asbestos products.

Step 2: Collect Evidence to Support Your Claim

You’ll need to gather evidence to support your claim. Your asbestos attorney and their team will help you and conduct investigations.

Evidence Typically Required

- Asbestos involvement: Medical documentation describing the extent to which asbestos contributed to the claimant’s disease

- Evidence of exposure: Evidence confirming asbestos exposure to a particular product or place, which may include witness affidavits, employment records and invoices

- Patient’s diagnosis: Medical documentation proving an asbestos-related diagnosis, generally pathology reports and imaging scans

Researching your work history is an important part of the process. You’ll also work with your medical team to gather diagnosis reports and other health information.

Step 3: Submit Your Claim

Once your attorney has gathered evidence, they’ll submit it per the asbestos trust’s protocols. Most trusts accept claims submitted through their websites. Other trusts may require the submission of a printed claim through the mail. Your attorney will find the best method to submit your claim to ensure a smooth approval process.

Step 4: Claim Reviewed for Approval

Asbestos trust funds have separate review processes for claims based on an individual’s asbestos exposure and particular life situation. Make sure to inquire with the trust’s administrators or ask your attorney to explain the process. The trust’s administrators will review the evidence in your claim.

People diagnosed with terminal diseases like mesothelioma who need compensation fast may consider an extraordinary claim. This is a good option if you meet the criteria for an expedited review and your exposure was from a single product or employer.

Evidence Review Processes

- Expedited review: Your claim will be grouped based on your diagnosis. This allows trust administrators to review claims faster. A fixed payment amount is associated with an expedited review. People typically receive payments faster than with an individual review.

- Individual review: Administrators will individually review your claim. This takes longer than an expedited review. They consider more factors in an individual study, such as the extent of your disease and how many dependents you have. The payment amount could be higher or lower than the fixed amount associated with an expedited review.

The payout offered in this review may move to arbitration if you’re unsatisfied with the amount. If arbitration fails, you may have the right to sue the trust. An experienced mesothelioma attorney has the expertise to know which type of asbestos trust fund review will likely result in a better outcome for your case.

Start filing your claim today so you and your family get the compensation they deserve.

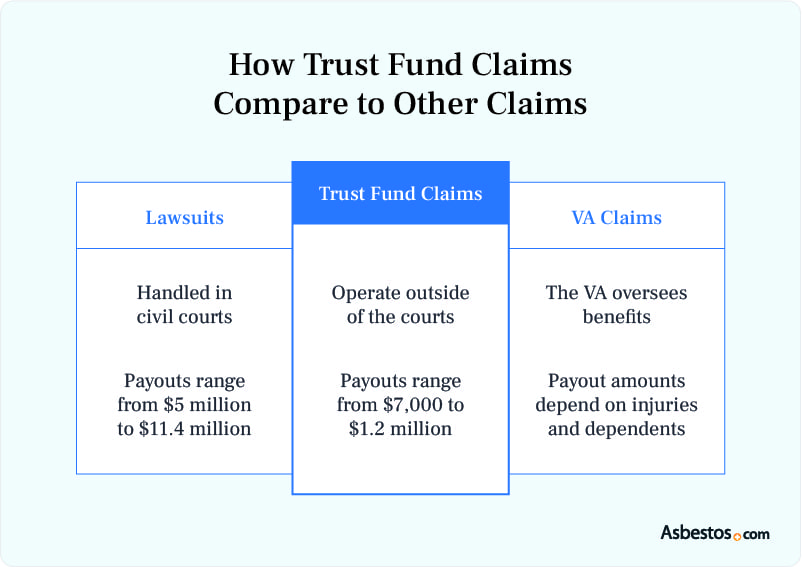

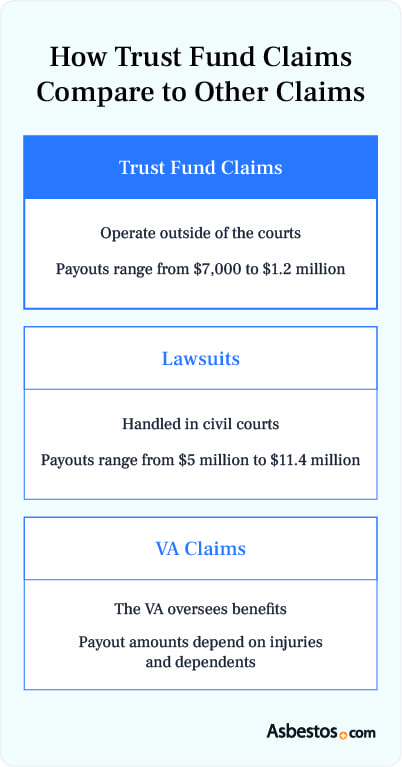

Start Your ClaimHow Do Mesothelioma Trust Fund Claims Compare to Other Mesothelioma Claims?

Filing a mesothelioma trust fund claim differs from filing a lawsuit. Mesothelioma trust fund claims generally offer a faster, more streamlined process with lower compensation than asbestos lawsuits. The trust fund’s administration is separate from the bankrupt or reorganized company.

A mesothelioma trust fund claim also differs from a VA claim. Veterans are eligible for veterans’ benefits and claims. VA claims aren’t legal claims. They offer compensation and health care to veterans of the U.S. armed forces and their families.

Mesothelioma survivors have several options for compensation. These options include asbestos lawsuits, Social Security Disability Insurance and personal insurance. A qualified mesothelioma law firm can help you determine your legal options.

How Are Asbestos Bankruptcy Trusts Created?

Mesothelioma trust funds are generally created through Chapter 11 bankruptcy courts. These trusts usually hold enough money to pay for future claims.

Creating Asbestos Bankruptcy Trusts

- Plan submission: Companies that can’t afford to pay asbestos liabilities must submit plans to a bankruptcy court for reorganization. These plans include how much will go into the trust for asbestos claimants and creditors.

- Estimates established: The court holds estimation proceedings. Similar to court trials, each interested group estimates how much should go into the trust. The proceedings also include testimony from experts knowledgeable about the value of past asbestos lawsuit settlements.

- Judge’s approval: The bankruptcy judge weighs the evidence, including the estimates and expert testimony. Once approved, the company transfers the money to a trust fund, which a trustee then manages.

- Trustee management: An appointed trustee manages the trust and the claimant process. They ensure enough funds are available to future claimants.

An experienced asbestos lawyer will know if the company responsible for your asbestos exposure has gone through this process of creating an asbestos trust fund. They’ll help you navigate the trust fund process.

Common Questions About Asbestos Trust Funds

- Will I need an attorney to file a mesothelioma trust fund claim?

-

It’s best to have an attorney file claims with the asbestos trusts, given the unique exposure and medical evidence necessary to successfully pursue a mesothelioma case with the asbestos trusts.

Answered By: Carl Money, Mesothelioma Attorney, Nemeroff Law Firm

- What are the pros and cons of filing an asbestos trust fund claim versus a lawsuit?

-

That is a question best answered by your mesothelioma attorney after discussions about your exposures and other variables.

Answered By: Carl Money, Mesothelioma Attorney, Nemeroff Law Firm

- Is asbestos trust fund compensation taxable?

-

Compensation from the asbestos trusts is not taxable.

Answered By: Carl Money, Mesothelioma Attorney, Nemeroff Law Firm

- How much is the average trust fund claim payout?

-

There is no average payout for claims against the asbestos trusts. Any compensation is determined by the evidence obtained against the asbestos companies in which claims were filed against the asbestos trusts.

Answered By: Carl Money, Mesothelioma Attorney, Nemeroff Law Firm

- Can a family member file an asbestos trust fund claim?

-

The mesothelioma victim, spouse, children, and heirs can file claims against the asbestos trusts.

Answered By: Carl Money, Mesothelioma Attorney, Nemeroff Law Firm